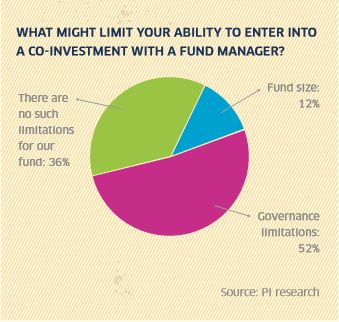

But Karen Dolenec, head of real assets at Willis Towers Watson, says: “At the deal level, once the co-investment is made, the manager is the one who is managing the asset. Of course there can be decisions required of co-investors along the way, but usually managers make sure that lack of governance by co-investors cannot impede action at the asset level.”

Fees is another big variable. Nick Warmingham, senior investment director at Cambridge Associates, says that if the investor is a limited partner in the fund, then there might not be a management fee. At other times there will be lower fees than usual, but at other times if there is no fund that the fund manager can market to other investors, the fees could be much higher.

Dolenec says the fee can also depend on the risk/return profile. “A full discount on fees is more common at the private equity end of the risk/return spectrum while very low risk real asset strategies such as long-lease property may see co-investments offered at minimal discounts,” she says.