According to the Pensions Institute at Cass Business School, DC assets are expected to grow six-fold to £1.7trn by 2030. A key part of DC as it evolves will be the design of default funds and so consultants will have their work cut out when it comes to advising on relevant investment strategies.

For this category we asked asset managers to rate consultants based on their ability to prepare for auto-enrolment, innovation in default fund design and ability to carry out due diligence around DC fund choices for platforms.

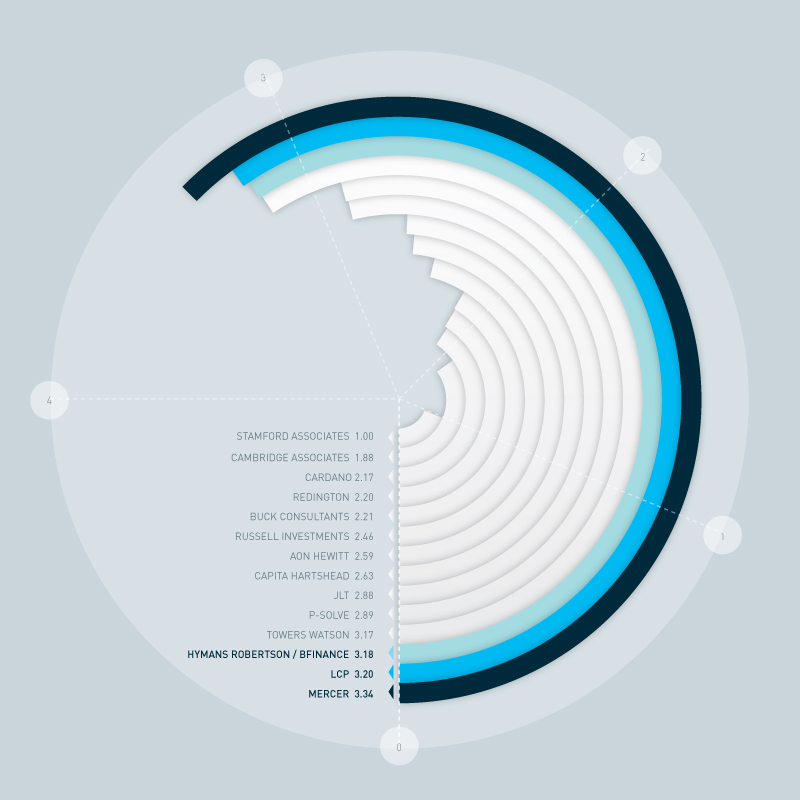

Once again, Mercer was rated the highest with 3.34 points, just pipping LCP, which received 3.20 points, to the post, while Hymans Robertson and bfinance shared third position with 3.18 each.

Innovation and development in DC pensions ranking

1. MERCER (3.34)

2. LCP (3.20)

3. HYMANS ROBERTSON / BFINANCE (3.18)

5. TOWERS WATSON (3.17)

6. P-SOLVE (2.89)

7. JLT (2.88)

8. CAPITA HARTSHEAD (2.63)

9. AON HEWITT (2.59)

10. RUSSELL INVESTMENTS (2.46)

11. BUCK CONSULTANTS (2.21)

12. REDINGTON (2.20)

13. CARDANO (2.17)

14. CAMBRIDGE ASSOCIATES (1.88)

15. STAMFORD ASSOCIATES (1.00)

Find out which consultant:

– Is most willing to take on board new ideas or products

– Is regarded the best to work with

Comments