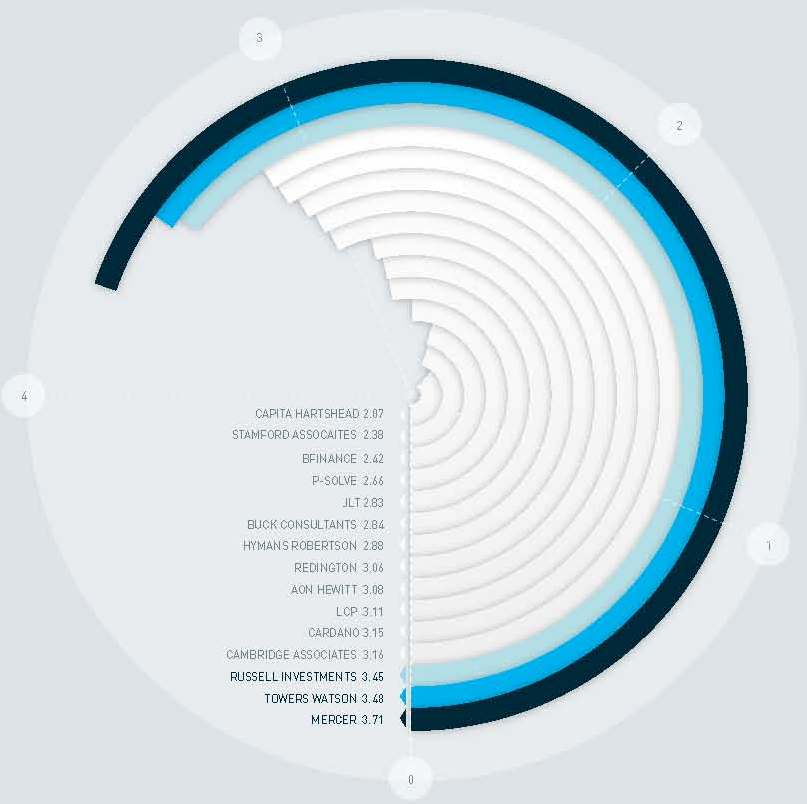

This category asked respondents to consider consultants’ research capabilities, paying particular attention to their knowledge of asset classes, their due diligence capabilities, the time it takes them to rate funds and the depth of questioning they subject fund managers to.

The top spot went to Mercer, which received 3.71 points, followed into second by Towers Watson (3.48) and Russell Investments in third (3.45).

One respondent said of Russell Investments: “Good and insightful questions with evident preparation beforehand.” Bringing up the rear in this category was again Capita Hartshead, which clocked up 2.07 points, just below Stamford Associates with 2.38 points.

Quality of research ranking

1. MERCER (3.71)

2. TOWERS WATSON (3.48)

3. RUSSELL INVESTMENTS (3.45)

4. CAMBRIDGE ASSOCIATES (3.16)

5. CARDANO (3.15)

6. LCP (3.11)

7. AON HEWITT (3.08)

8. REDINGTON (3.06)

9. HYMANS ROBERTSON (2.88)

10. BUCK CONSULTANTS (2.84)

11. JLT (2.83)

12. P-SOLVE (2.66)

13. BFINANCE (2.42)

14. STAMFORD ASSOCIATES (2.38)

15. CAPITA HARTSHEAD (2.07)

Find out which consultant:

– Is most willing to take on board new ideas or products

– Is regarded the best to work with

– Is best for innovation and development in DC

– Was voted the UK’s best investment consultant

Read portfolio institutional‘s view

Comments