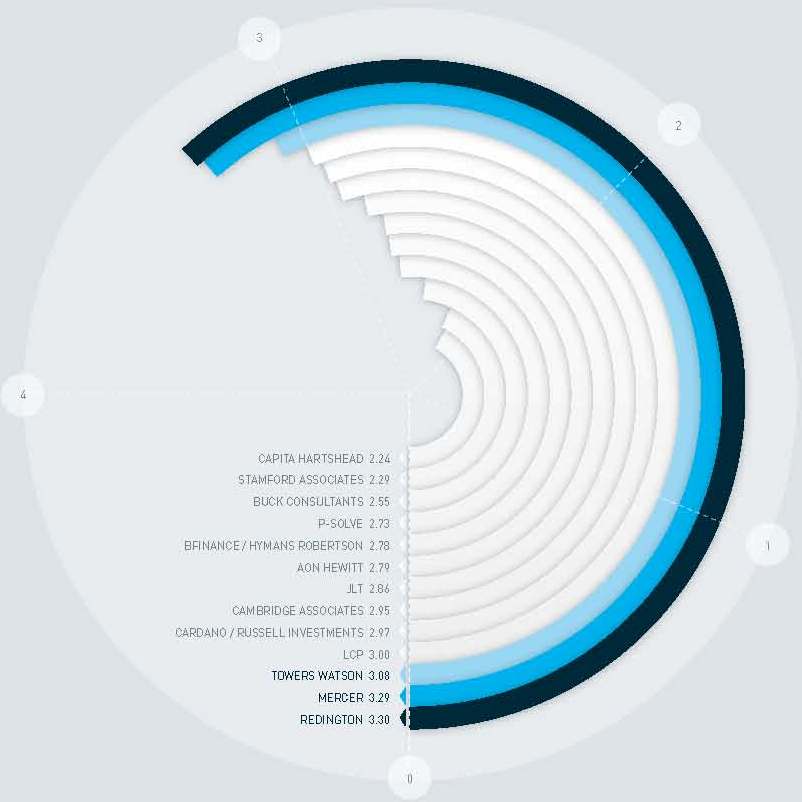

For this category, respondents were asked to rate consultants based on how open they were to taking on board funds and strategies and then recommending them to clients; and whether they were forthcoming with new ideas themselves.

Redington came out on top in this category, with a score of 3.30. One respondent said: “[Redington] lack the research depth of Mercer and Towers Watson, but their key thinkers are as good and innovative as anyone in investment consulting.”

In second place was Mercer (3.29), followed by Towers Watson in third (3.08). Ranked last in this category was Capita Hartshead with 2.24 points, just below Stamford Associates in 14th with 2.29 points.

Willingness to take on board ideas or products ranking

1. REDINGTON (3.30)

2. MERCER (3.29)

3. TOWERS WATSON (3.08)

4. LCP (3.00)

5. CARDANO / RUSSELL INVESTMENTS (2.97)

7. CAMBRIDGE ASSOCIATES (2.95)

8. JLT (2.86)

9. AON HEWITT (2.79)

10. BFINANCE / HYMANS ROBERTSON (2.78)

12. P-SOLVE (2.73)

13. BUCK CONSULTANTS (2.55)

14. STAMFORD ASSOCIATES (2.29)

15. CAPITA HARTSHEAD (2.24)

Find out which consultant:

– Has the highest quality research

– Is regarded the best to work with

– Is best for innovation and development in DC

Comments